2020年岸桥市场波澜不惊,ZPMC继续保持市场份额增长

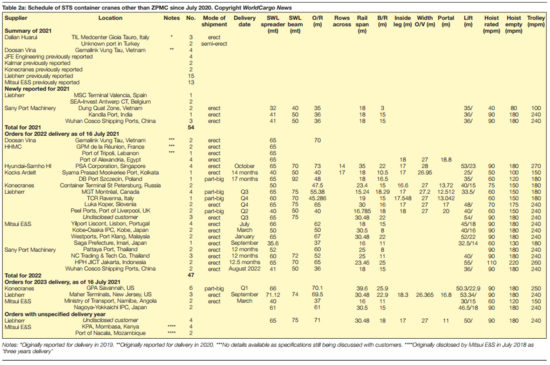

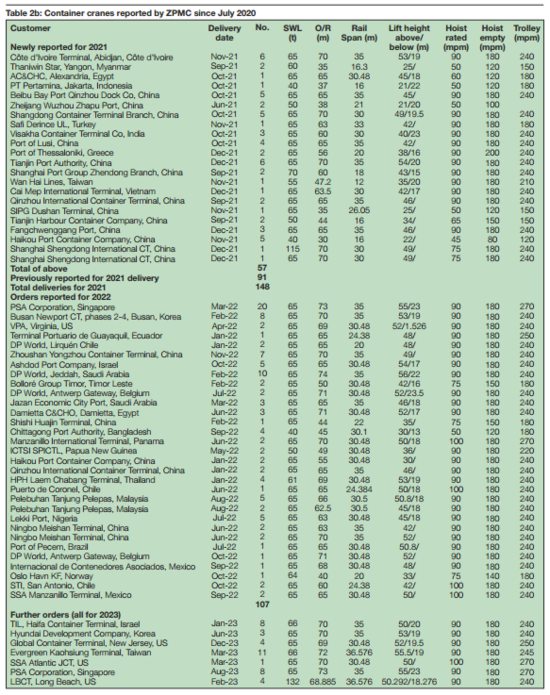

从本报第 28 届年度岸边集装箱起重机的市场占有率调研中,不难看出振华重工逆势而上,在市场总体下滑的情况下仍然保持其市场份额的增长。自2021 年年中开始直至 2022 年已经确立了领先地位。截至 2021 年 7 月,振华重工披露了 2022 年的岸桥的订单数量为 107 台,所有其他制造商加在一起只有 47 台岸桥,对比往年数据, 2021年振华重工和其他制造商的该项数据分别为 91 台和 46 台。

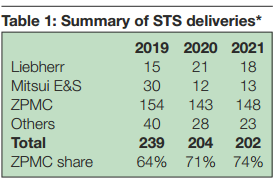

The main message from the 28thWorldCargo Newscrane survey is apparent from annual STS Table 1 – ZPMC has been increasing its

market share in a falling market. To the extent that one can determine the 2022 position from mid-2021, the pattern will be similar. ZPMC has reported 107 crane bookings for 2022 and all other suppliers have reported a total of 47 units, compared with 91 and 46, respectively, for

2021, as of July 2021.

市场上似乎发生了一些奇怪的事情。一方面,运费飞涨,集装箱货运服务水平暴跌,错失的船期给港口运营商带来压力,但这并没有转化为对岸桥的需求增加。

There appears to be something odd happening in the market. On the one hand, freight rates have skyrocketed and liner service levels have plummeted, with missed schedules piling the pressure on port operators, but this is not being translated into an increase in the demand for

STS cranes.

过去三年的总体格局基本相同,新冠疫情显然对整体影响不大。从表面上看,在 2020 年 7 月和 2020 年底之间,振华重工今年订购了另外 57 台岸桥以供交付,这看起来很了不起。

The overall pattern of the past three years is basically the same, with the coronavirus pandemic apparently having little overall effect, one way or the other. On the face of it, it looks remarkable that between July 2020 and the end of 2020 (realistically, that has to be the cut-off given crane lead times), ZPMC booked another 57 cranes for delivery this year.

当然,其中一些可能已经“敲定”的项目。截至 2020 年 7 月,即便,在 2020 年下半年,存在旅行限制、面对面谈判的困难等,仍有相当数量的岸桥被确定了。然而,这 57 台岸桥中有 41 台是为中国客户提供的,“国内”市场比海外项目更容易解决。

Of course, some of these may already have been ‘on the books’, but not disclosed as of July 2020, but even so, there must be a fair number that were booked in H2 2020, despite travel restrictions, the difficulties of conducting face-to-face negotiations, and so on. However, 41 of those 57 cranes were for customers in China, and the ‘home’ market would have been much easier to address than projects overseas.

这引出了另一个值得注意的点。2020 年和 2021 年,振华重工交付的岸桥分别不少于 66 台(46%)和 81 台(55%)至中国港口。如果中国市场没有这种相对的“活力”,全球岸桥市场将处于非常糟糕的状态。

没有影响?

在本报今年的调查中,要求受访者说明交付量是否因新冠疫情而“下滑”,但答案显然是否定的。我们只知道最近三个项目取消,和疫情没有关系。这些是:

When canvassing for this year’s survey,WorldCargo News asked respondents to indicate whether deliveries had ‘slipped’ because of the pandemic, but the answer is apparently no. We are aware of only three recent project cancellations, and they have nothing to do with the pandemic. These are:

※振华重工,由于印度和中国之间的高层政治争端,其被授予伊朗恰巴哈尔 12 台岸桥于 2021 年交付的合同被取消;

● ZPMC’s award by IGPL for 12 cranes for Chabahar in Iran for delivery in 2021 was cancelled because of the high-level political dispute between India and China

※韩国Hyundai-Samho公司由 Anaklia 开发财团授予的 2021 年交付给格鲁吉亚的四台岸桥的合同被取消,因为该项目已经破裂。格鲁吉亚政府正在正式寻找新的合作伙伴,以推进这一有争议的项目。

● Hyundai-Samho’s award of four cranes by Anaklia Development Consortium for delivery in 2021 to the new port in Georgia was cancelled because the project has fallen apart. The Government of Georgia is officially looking for new partners to take this controversial project forward.

※科尼在 2021 年上半年“2019 新冠疫情报告”中 ,“由于新冠疫情,全球需求仍有波动”。这适用于科尼公司的所有业务部门——工业、港口和服务。关于港口,该报告指出,“全球集装箱吞吐量继续创下历史新高,全球集装箱装卸的长期前景总体上保持良好”。该公司的订单量同比增长 38.7%,“受所有三个业务领域订单量的推动”。

Providing a ‘glimpse’ into the general picture, Konecranes, in its H1 2021 interim report, noted that “the worldwide demand picture remains subject to volatility due to the COVID-19 pandemic”.This applies to all Konecranes’ business segments – industrial, ports and service.Regarding ports, the report noted that “global container throughput continues to be at a record high, and long-term prospects related to global container handling remain good overall”. The company’s order intake increased by 38.7% year-on-year, “driven by order intake in all three business areas”.

正如本期头版报道的那样,科尼的合并伙伴卡哥特科在其同一时期的港口指出,今年集装箱装卸设备市场的大部分增长来自小型移动设备。始于 2020 年下半年的货运量激增令市场感到意外,而且这一趋势将持续多长时间,或者第四次浪潮引发的另一次冠状病毒相关破坏是否会对中国作为生产来源地产生影响,还有很多不确定性。

As reported on the front page of this edition of WorldCargo News, Konecranes’ merger partner, Cargotec, noted in its report for the same period that most of the growth in the container handling equipment market this year is in smaller mobile equipment. The cargo surge that began in the second half of 2020 surprised the market, and there is a lot of uncertainty over how long it will last, or if another coronavirus-related disruption from a fourth wave will have an impact on China as a source of production.

谨慎的做法

无论如何,最新的岸桥数据表明,港口运营商正在谨慎行事。总的来说,“绿地”开发的“大潮”已经过去。正如人们认为未来的自动化项目可能侧重于“棕色地带”的改造和开发一样,人们可以预期岸桥的需求将更加零散和分馏。

In any event, the latest crane figures indicate that port operators are being cautious. Generally speaking, the ‘great wave’ of ‘greenfield’ developments has passed.Just as future automation projects are thought likely to focus on ‘brownfield’ conversions and developments, one can expect crane demand to be more piecemeal and fractionalised.

目前,码头运营商在运营码头时也有些不知所措。制定扩张计划不是当前的首要任务。

Terminal operators are also somewhat overwhelmed at the moment with running their terminals. Making plans for expansion is not the top priority currently.

此外,在过去五年中,码头运营商需要大量投资于新的岸桥,并提高现有岸桥的高度,以跟上船舶尺寸的增长。虽然大量资本投资于码头,但吞吐量的增加并不一定支持这一点。马士基首席执行官 MortenEngelsoft 在今年早些时候向市场发表的评论中表示,公司计划在未来五年投资 6 亿美元用于码头,但他预计这不会包括大量新岸桥,因为马士基码头主要用于选择性设备和过程自动化项目。

岸桥市场也受到时间的影响。目前集装箱运输的繁荣推动了一些港口项目,特别是在美国东海岸和墨西哥湾沿岸地区,包括路易斯安那州杰克逊维尔(路易斯安那国际集装箱码头),以及加拿大新不伦瑞克的圣约翰。这些项目的支持者指出了港口拥堵问题,并提出了自己的观点,但大多数项目离订购岸桥还有一段时间。

The STS market is also impacted by timing. The current boom in container shipping has given impetus to some port projects,particularly at US East Coast and Gulf coast locations, including Jacksonville, Louisiana (Louisiana International Container Terminal and, separately, Plaquemines), as well as Saint John in New Brunswick, Canada. The proponents of these projects are pointing to port congestion and pushing their case, but most of them are some time away from ordering STS cranes.

最后,我们有理由相信,我们已经描绘了一幅准确的市场需求图。只有两家制造商,现代三湖和大连华瑞,没有对我们的调查做出回应。MGM-OMG 回复称,该公司不希望进行合作,但据了解该意大利公司没有任何岸桥订单。据了解,大连华瑞在 3 月份向土耳其港口装运了两台岸桥,但我们无法确定任何信息。

Finally, we can be reasonably confident that we have painted an accurate picture of market demand. Only two OEMs – Hyundai-Samho and Dalian Huarui– did not respond to our survey. Bedeschi (MGM-OMG) replied saying it did not wish to comment, but the Italian firm is not thought to have any firm orders for STS cranes. It is understood that Dalian Huarui shipped two STS cranes to a Turkish port in March, but we have been unable to ascertain any information.

TIL-MSC 和大连华瑞对意大利吉奥亚陶罗港的六台岸桥保持高度保密。幸运的是,2019 年政府在罗马指出,港口特别专员安德里亚·阿戈斯蒂内利(Andrea Agostinelli)的态度要积极得多。他透露,2019年交付了三台岸桥,但截至今年 2 月只有一台投入使用。其他三台岸桥也将于 2019 年交付,目前计划于今年交付。根据 Agostinelli 的说法,问题在于这些岸桥最初不是为在欧洲使用而制造的。虽然情况仍然有些神秘,但我们已经调整了 2019 年和 2021 年的总体交付记录,以反映Agostinelli 的信息。

TIL-MSC and Dalian Huarui remain very secretive about six cranes for Medcenter in Italy’s Port of Gioia Tauro. Fortunately,Andrea Agostinelli, the port’s extraordinary commissioner appointed by the government in Rome in 2019, has been much more forthcoming. He revealed that three cranes were delivered in 2019 but only one had gone into service as of February this year.The other three cranes, which were also due for delivery in 2019,are now scheduled for delivery this year. According to Agostinelli,the problem has been that the cranes were not originally built for use in Europe (see WorldCargo News, April 2021, p16). While the situation remains something of a mystery, we have adjusted the overall delivery records for 2019 and 2021 to reflect Agostinelli’s information.

考虑到的其他“下滑”包括Doosan Vina 岸桥(2020 年至 2021 年)和BCT Riga 的三一岸桥(2019 年至 2020 年)。可能是由于新冠疫情的限制,这些订单被取消了。

Other ‘slippages’ taken into account are the Doosan Vina cranes for Gemalink (from 2020 to 2021)and a Sany crane for BCT Riga (from 2019 to 2020). It could be that these orders were rescheduled due to pandemic restrictions.

大跨距

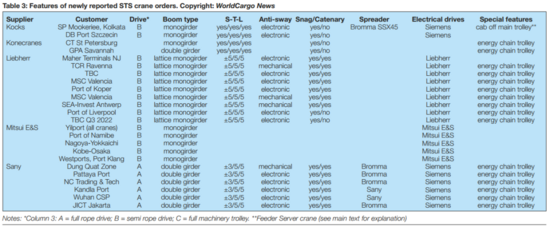

最近订单的有一个突出特点是,在可能的情况下(绿地项目和扩建项目),为更大的岸桥选择更宽的跨距(通常为 35m)。这与安全无关。在过去的几年中,在只有 19 米甚至 18 米的跨距上做了加高的岸桥,取得了一些非凡的成就,在原有跨距上,现有岸桥的高度也有了一些惊人的提高(高达五层)。

One standout feature of recent orders is the selection of a wider rail span (typically 35m) for bigger cranes where possible (greenfield developments and berth extensions). This is not about safety. The past few years have witnessed some extraordinary engineering achievements with long and tall cranes on 19m and even 18m rail spans, and some spectacular height increases (up to five more tiers) of existing cranes on their original rail span.

过去五年的本报得调查数据显示,共有 1262 台 STS 岸桥订单,包括铁路跨度。其中,21%的订单用于 30 米以下的跨距,49%用于 30 米到30.5 米之间的跨距,30%用于 30.5 米以上的跨距。

Data from WorldCargo News STS surveys over the past five years show that there were 1,262 STS crane orders with rail span reported. Of that number, 21% of orders were for gauges of less than 30m, 49% were for spans between 30m and 30.5m, and 30% were for spans greater than 30.5m.

值得注意的是,30 米/100 英尺的长度一直是标准长度,从最初的后巴拿马型船舶有 16 排,一路高达 20000 多艘标准箱船舶,堆放 22 或23 排,但这说明了在现有码头的后场的限制,在那里,后场可能不够宽,或者基础设施工程会造成太大的破坏。

It is remarkable how long 30m/100ft has been the norm, starting with the original post-Panamax ships with 16 rows across, all the way up to 20,000-plus TEU ships stacking 22 or 23 rows across, but this illustrates the constraints on fitting an extra rail into the backland of an existing terminal, where the apron may not be wide enough, or the infrastructure work would be too disruptive.

额外的宽度是关于控制总质量和提供更好的负载分布。更长和更高岸桥的更大跨度的突出例子包括PSA新加坡的大士港和阿比让的马士基科特迪瓦码头(CIT)二期的装置,这两个绿地项目,以及萨瓦纳港扩建项目,美国乔治亚港务局选择了 130 英尺(近 40 米)的跨度。科特迪瓦码头(CIT)最初成立于 2013 年,一期由阿比让自治港管理,包括将运力翻番至 2015 年完成的 150 万标准箱。科特迪瓦码头(CIT)二期合同于去年 8 月与中国港湾工程公司签订并建设从 10月开始,马士基和 Bolloré立即订购了岸桥。

显然,如果需要,科特迪瓦码头(CIT)第二阶段将能够处理世界上最大的集装箱船。它将配备六台起重量 65 吨、70 米外伸岸桥,由振华重工在 1100m 的码头上安装,深度为 18m,而现有设施为 11.5m。

码头也采用 30.5m/100ft 跨距,用于相对较小的外伸岸桥,在过去可能使用较窄的跨距。一位参与最近一个项目的顾问向码头建议,对于使用寿命为 75 年的基础设施资产,不再建议使用较窄的跨距。即使码头目前在技术上不需要 100 英尺的跨距,但它仍为更广泛的可能性敞开大门,包括为水平运输自动化提供更多空间,以及为未来可能需要的任何岸桥扩建创造更好的基础。如果需要的话,100 英尺长的岸桥也更容易出售或转移到另一个码头。

展望未来

目前尚不清楚交付或订购的岸桥中有多少能够远程操作,无论是在交付时还是为将来切换到远程操作而预先设计的。展望未来,在这些调查中,这是值得跟踪的,但制造商会谨慎地透露他们的客户可能认为“敏感”的信息。

It is not known how many cranes being delivered, or on order, are capable of being remotely operated, either on delivery or pre-designed for switching to remote operation at a future date. Going forward,

Kocks 给印度加尔各答港制造的岸桥司机室不在小车上。要明确的是,这台岸桥属于 Kocks 著名的Feeder Server系列,外伸距 40 米(如本例所示)。Kocks 解释说,Feeder Server设计的一个标准特征是司机室安装在主小车后面的一个单独小车上。这意味着驾驶员不会暴露于与岸桥操作相关的正常振动、冲击载荷和“负载病”。

Kocks 也是唯一提供起升机和小车加速度信息的制造商(0.5 米/秒

2)。

Kocks was also the only OEM to supply information on hoist and trolley accelerations – 0.5 m/sec2 for both its new orders.

声明:本文系转载自互联网,请读者仅作参考,并自行核实相关内容。若对该稿件内容有任何疑问或质疑,请立即与铁甲网联系,本网将迅速给您回应并做处理,再次感谢您的阅读与关注。

不想错过新鲜资讯?

微信"扫一扫"